|

| From Wikicommons |

Okay, equations may not be your cup of coffee. But knowing the numbers is key to saving money, and performing simple computations can mean the difference between living well and scraping by. Frankly - and I realize this is simplifying the issue beyond measure - but I occasionally wonder how many U.S. foreclosures could have been avoided if someone sat down with a calculator. (Judgey? Me? Er … maybe.)

Math is especially essential in the supermarket, from estimating discounts to figuring unit prices. Occasionally, you even have to guess at measurements and conversion rates, which is always a good time.

Granted, this isn’t intuitive knowledge. But it is very, very necessary knowledge. So, how do you make trips to the market a little easier? These tips might help.

Create a pricebook.

Though it’s a little intensive at first, a good pricebook will help you nail the best deals on food. Once you have it down, you won’t even need to record numbers anymore. You’ll just know. Of course, they’re a bit complicated to explain in two lines, so I’ll refer you to this masterful post at Get Rich Slowly, which includes links to spreadsheets. This CHG comp of pricebooks, meal planners, and grocery lists is way useful, too.

Make a grocery list, pricing included, before you get to the store.

You’re less likely to make mistakes at home when you have time and relative peace to run the numbers of a given purchase. Derive costs from online circulars or your own hard-won knowledge, factor in coupons, and don’t forget any membership card discounts.

Bring a calculator with you as you shop.

This eliminates the need for in-your-head math, making nearly any in-store purchase much easier to figure. Can’t find a Texas Instrument? Use your cell phone. Almost all models should include a simple (read: non-scientific, but you won’t have to figure out cosines, anyway) math machine.

Keep a running tally in your head of what you buy.

Estimating your purchases as you shop goes a long way toward staying within a budget. It doesn’t have to be exact, because odds are the digits will work out at the end. Waiting on line is a perfect place to do this, especially if there aren't any good tabloids to read.

Learn this simple math trick.

Take an item’s price and move the decimal point to the left by one spot. The new number is 10% of the cost. You can use that to approximate nearly any discount. Multiply it by three to get a 30% discount, or five to calculate a half-off price.

Loaf of bread = $3.92

10% = $0.39

20% off = ~$0.78

Half off (50%) = ~ $1.95

Relatedly, to derive the individual cost of a Buy One Get One free item, simply split the price in half.

Compare unit pricing.

Supermarkets will frequently present you with two prices. The latter is the cost of a specific item. For example, the price of these egg substitutes is $3.49.

The former is what that item costs in a standardized size or quantity. A full quart of these egg substitutes will run you $7.98.

Using that former number, you can compare the cost of a quart of egg substitutes to quarts of competing products. Maybe another brand goes for $10.15 per quart, making it more expensive. Or perhaps it costs $6.98, a better price.

Beware, though. Sometimes, similar products will use different units of measurement to list their unit pricing. In that case, it’s handy to have that calculator.

|

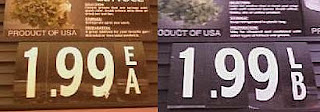

| Note the pound vs. quart measurements here. |

Okay. Like, “duh,” right? But hear me out: Weighing produce will not only give you an idea of cost, but a visual representation of just how much food you’re buying. Plus, it makes it easier to find a bargain when you’re confronted by pricing like this:

Which is the better deal, $1.99 per pound, or $1.99 per bunch? Only the scale knows for sure.

These rules are fairly basic, sure. But really, they’re here as a reminder that frugality is a numbers game. And in order to succeed, we hafta stay on top of them.

Readers, whaddaya think? Are there other math tips to be added? Do you think math is as important to financial health as I’m making it out to be? Will you now have an answer for your kids when they ask, “Why do I have to learn this?” The comment section, she is open.

~~~

If you enjoy this, you might also appreciate:

No comments:

Post a Comment